Trident Techlabs Deep Dive - A unique play in nexus of Power, Semiconductor, Renewable and Defence sectors. Should this company be in your radar?

Powering India's Tech Future: From revolutionizing power systems to semiconductor design, Trident Techlabs is set to ride significant tailwinds across defense, power,and emerging tech sectors.

Ticker: TECHLABS | Sector: Technology Solutions | Industry: IT-Software | Market Cap: 2,387Cr. | Stock Exchange: NSE-SME | CMP: 1311.80

Company Overview:

Trident Techlabs, established in 2000, began as a supplier of pre-packed computer software and has since evolved into a dynamic technology solutions provider. The company focuses on engineering and power system solutions, offering services like custom electronics design, technical education tools, and advanced power engineering solutions.

Key offerings include products and tools for FPGA and ASIC design, power distribution systems, and consulting on power system analysis. Trident Techlabs aims to bridge technology with business needs, helping clients across industries create innovative and adaptable solutions.

What does the company actually sell?

Trident Techlabs sells engineering software, tools, and consultancy services designed to support industries like aerospace, defense, telecommunications, and power systems.

They provide specialized software that allows engineers to design and test systems—like electronic circuits, mechanical parts, or power grids—virtually. Instead of building a physical prototype, users can simulate and optimize how their system will work in different scenarios on a computer. This saves time, reduces costs, and ensures the final product meets the desired performance standards before real-world production.

Trident Techlabs acts as an implementation partner for these companies’ software solutions. They don’t just sell the software; they help clients integrate and customize these tools to meet specific industry needs.

One practical example is Trident Techlabs’ implementation of Eaton’s CYME software, which is used for network load analysis and power system planning. For power utilities or industries with complex electrical grids, CYME allows detailed analysis of network behavior, helping optimize load distribution and system reliability. Trident Techlabs ensures the software is integrated seamlessly, trains users, and offers support to leverage CYME for practical applications like reducing power losses or planning new substations.

This approach resembles how Indian IT firms like Infosys or TCS implement enterprise software such as SAP or Salesforce. These firms don’t just install the software—they adapt and integrate it into the client’s business processes, ensuring it solves specific challenges. Similarly, Trident Techlabs customizes and implements solutions from its channel partners, ensuring businesses can maximize efficiency and achieve their goals through advanced technology.

Business Overview:

The company offers custom-built technology solutions to corporates in the aerospace, defence, automotive, telecom, semiconductor and power distribution sectors. They primarily have two business verticals i.e. Engineering Solutions and Power System Solutions. They are also branching out to Semiconductor design and cybersecurity which are briefly discussed below.

Domains Active in:

Electrical Power: Techlabs has been active for more than two decades in the field of the electric power and has been offering the range of engineering consultancy services and the software solution aimed at improving the operational efficiency of electric power delivery system. There are the instances of the power distribution companies having energy losses in their network on sustained basis and improve its financial performance by as much as 20% by anticipating the problem which may inflict with their network and implementing remedies thereafter in the time.

Defense and Aerospace: Techlab has a history of more than two decades of working with the defense and aerospace establishment in India, offering them the space-like system design and services.

DRDO is their biggest Defence Client

Recently signed contract with Indian Navy to provide subservices.

Semiconductors: Realizing its importance in the advanced electronic system, a new ecosystem has emerged in India in the last decade, which includes the company's offering design services at different scale in India and majority overseas for the majority of overseas clientele.

In advanced stage to acquire and establish design house, which serve a global clientele and have all the capability to ramp up revenues by earning.

Sizable share in the market for design services in Indian semiconductor industry and notable presence in North American market.

Cybersecurity: In the wake of the recent hack of their IT infrastructure by the adversary countries, the defense and space research industries in India have begun to keep their specific budget for creating and maintaining the necessary safety system.

TechLab intend to establish a relatively early player in this market segment and has recently carried out a pilot project for the defense establishment in India.

Key Segments:

Engineering Solutions: The engineering solutions division operates as a knowledge-based solution-cum-service provider in the field of technical education. Engineering Solutions portfolio of products and related services encompass a diverse spectrum of solutions viz. system-level electronics design, chip-level electronics design, embedded design, hydraulics/ pneumatics system, system modelling, reliability and quality, design automation, power electronics, PCB designing and electromagnetic simulations.

Power Systems: Power solution division offers range of advisory services and solutions aimed at improving the efficiency of electrical power delivery systems and development of customer and asset information systems. Power Solutions portfolio of products and related services help power distribution utilities who face new challenges due to the ever-changing nature of the industry and the increasing pressure on network reliability. They provide engineering services to the power distribution industry. The Company is mainly focused on providing specialized engineering and managerial services to the power sector in various fields like Transmission systems planning and studies, Distribution Systems planning and studies, Industrial Power Systems planning and studies etc.

Key Customers:

The company has a client-base of over 500 organizations in the Engineering Solutions space and more than 150 organizations in Power Systems Solutions space, located in India and other parts of the world like South-East Asia, Middle East, China, Bangladesh and Sri Lanka etc. They also have Fortune 500 clients in the semiconductor and automobile industry.

Channel Partner Ecosystem:

Trident Techlabs collaborates with a network of renowned channel partners, as highlighted in the image below.

These include:

Cadence: A leader in electronic design automation (EDA) software for designing and validating advanced semiconductor devices.

Mentor Graphics (A Siemens Business): Specializes in software for EDA, offering solutions for IC design, verification, and embedded software development.

National Instruments: Known for its hardware and software platforms like LabVIEW, used for system design, testing, and measurement.

Eaton: Focuses on power management technologies, offering tools and software for energy-efficient systems.

ESI Group: Provides simulation solutions for areas such as propulsion systems, airflow simulations, and noise cancellation systems.

SWOT Analysis:

Strenghts:

The company operates in defence, power and semiconductors verticals that are facing secular tailwinds and are expected to grow at an above-GDP rate for the next decade. The primary strenghts of the company are:

Experienced Management: Trident Techlabs Limited boasts a highly experienced management team that plays a crucial role in driving the company's growth and innovation across various sectors, including electrical power, defense, aerospace, semiconductors, and cybersecurity.

The leadership includes Sukesh Chandra Naithani as CEO and CFO, with over 35 years of experience in IT and electronics, known for fostering innovation and optimizing business processes.

Praveen Kapoor, the Managing Director, brings over 34 years of expertise in electrical power systems, focusing on strategic vision and performance alignment.

Sharad Naithani serves as Chairman and Non-Executive Director, leveraging over 36 years of experience in business development and marketing.

The technical leadership is strengthened by George Anil D Silva, CTO of Engineering Solutions, with over 25 years in semiconductor EDA products, and Tushar Bhanudas Borole, CTO of Power Solutions, who has more than 30 years in power system engineering.

Dr. Subhash C Sati adds significant defense expertise with a 37-year tenure at DRDO.

The team is further supported by C. T. Bhadran and Joe Basker, both bringing extensive experience in ICT products and power solutions respectively.

Defence Partnerships: Trident Techlabs Limited has established a strong and ongoing relationship with the Defence Research and Development Organisation (DRDO) of India, collaborating on various projects and providing essential services in the defense sector. This partnership highlights Trident Techlabs' significant role in supporting India's defense technology development.

Key Aspects of the Relationship: Collaboration and ServicesTrident Techlabs works closely with DRDO, offering specialized system-level design solutions for the defense sector. The company provides high-precision Electronic Design Automation (EDA) tools and engineering expertise for performance verification in electronics and mechanical systems. This collaboration supports the indigenization and modernization of defense technology in India.

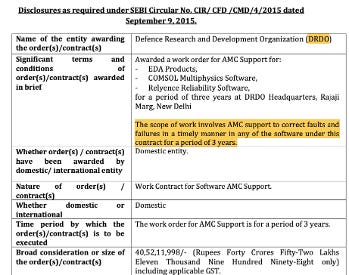

Recent Developments: In May 2024, Trident Techlabs received a significant work order from DRDO worth ₹40.52 crore. This order is for providing Annual Maintenance Contract (AMC) support for EDA, COMSOL, Multiphysics, and Reliability Software Suite. The company has also been awarded projects by DIT & CS (DRDO), Dehradun, which contributed 79% to their Engineering Solutions Group (ESG) segment in a recent financial year.

Long-term Association: Trident Techlabs has been working with DRDO for several years. The company has successfully completed projects for clients in the defense sector, including DRDO. It is positioned to provide specialized services for System-on-Chip (SoC) design and manufacturing of products on Transfer-of-Technology from DRDO.

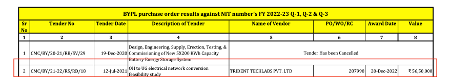

Below is a bid document by the Ministry of Defense from July 2024. The bid is issued by the Ministry of Defence under the Department of Defence Research & Development for the procurement of Altair Power Electronics Design and Simulation Software (Altair PSIM). PSIM is specialized software widely used for designing, analyzing, and optimizing power electronics systems. It allows engineers to model circuits, analyze performance, and improve efficiency, making it a critical tool in advanced electronic design.

This procurement is classified under the Proprietary Article Certificate (PAC), which restricts bidding to specific vendors due to the proprietary nature of the product. PAC procurement, governed by Rule 166 of the General Financial Rules (GFR) 2017, is applied when a product or service has unique specifications and can only be sourced from the original manufacturer (OEM) or their authorized distributors. The rationale for PAC classification is to ensure the procurement of specialized, high-quality goods that have no viable alternatives.

For companies like Trident Techlabs Pvt Ltd., being listed as an authorized distributor provides a significant competitive advantage. In PAC tenders, competition is limited to a handful of pre-approved vendors, improving their chances of securing the contract. This process also ensures that the buyer acquires the exact specified product while adhering to procurement compliance and efficiency standards.

Exclusive Channel Partnerships: Eaton and Trident Techlabs have established a significant channel partnership that spans multiple areas of collaboration and business expansion. Trident Techlabs serves as an exclusive channel partner for Eaton's CYME International T&D subsidiary in India. This collaboration focuses on providing comprehensive technical support services for CYME's Power System Engineering Software, which is widely used by electric utilities, industrial organizations, consultants, and research institutions for electrical power engineering simulations. Key Aspects of the Partnership:

Software Distribution and Support: Trident Techlabs offers CYME's extensive line of Power Engineering Software to the Indian market. They provide comprehensive technical support services to clients, ensuring optimal returns on software investments.

Market Expansion: Through this partnership, Eaton has expanded its reach into Southeast Asia, the Middle East, and North Africa. Trident Techlabs leverages Eaton's global leadership to deliver custom software, decision-support systems, and network planning expertise to power distribution companies.

Technical Seminars and Training: The partnership involves hosting joint technical seminars to showcase CYME software capabilities. These events aim to address present and prospective needs of clients in power system analysis.

Client in Focus: Tata Power Delhi:

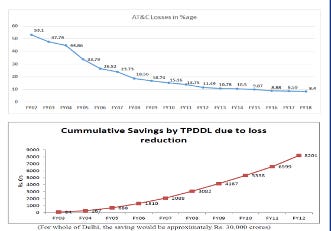

CYMDIST, a power distribution network analysis software developed by CYME International, has played a significant role in enhancing Tata Power Delhi Distribution Limited's (TPDDL) operational efficiency. Tata Power Delhi has gained significant in reducing high level of energy losses in their power distribution network from 52% to 6% on sustained basis, attaining the maintenance world-class reliability of the power supply and cut down capital investment in their even-grown power network by eliminating the practices of ad hoc growth plans for their network plan for these networks.

Trident Techlabs has provided complete set of software and services, including the customer's custom-built electric network assistant information and analysis system to diagnose weak points on their power network under the current conditions and in the future.

TPDDL is using CYMDIST software to improve how they manage their electrical network and assets. The software acts as a central hub, connecting different parts of their system. It takes information about the electrical network from a mapping system (GIS) and combines it with data from other business software like SAP. This allows TPDDL to analyze their network, plan improvements, and keep track of their equipment more effectively. The system is set up with different computers and servers working together to process all this information. By using CYMDIST, TPDDL can make better decisions about maintaining and upgrading their power distribution system, which ultimately helps them provide more reliable electricity to their customers.

Weaknesses:

While the company is involved in many upcoming verticals and have partnerships with key organizations in their industry, the company has fair share of weaknesses that might warrant investor’s attention:

Concentration of Clients: The Top 05 clients contributed 69.32%, 86.73%, 57.21% and 41.63% of aggregate revenues for the period ended on October 31, 2023 and financial year ended March 31, 2023, 2022 and 2021, as per the restated consolidated financial statements. The same concentration stands at 80% for FY24. The highest contribution in PSG segment is contributed solely by South Bihar Power Distribution Company Ltd (Patna) in FY24. In FY24, the highest contribution in the Engineering Solutions Group (ESG) segment came from DIT & CS (DRDO), Dehradun, accounting for 79% of the segment revenue. As of August 31, 2024, DRDO contributed 91% of Trident Techlabs' total order book.

The risk is somewhat mitigated by the company’s strong, long-term relationships with clients, most of whom are large institutions or government organizations with solid credit profiles. This reduces counterparty risk. Additionally, client concentration fluctuates based on the orders received, which helps diversify risk. The stable creditworthiness of these major customers adds further reassurance regarding counterparty exposure.

Bad Outstanding Receivables: Looking at the Accounts Receivables that Trident Techlabs reported in their DRHP last year, we see that about 26 crores have been outstanding since past 3 years.

This becomes especially concerning considering the small revenue base company was operating on couple of years back. The payment of Rs 24.76 crore is primarily pending from orders executed for Dhaka Electric Supply Company Limited (DESCO) and Dhaka Power Distribution Company Ltd. These projects began in 2019 but have faced delays due to COVID-19 and the current political unrest in Bangladesh. As of March 31, 2024, Rs 26.63 crore was recoverable from the completed portions of the projects, with Rs 1.87 crore recovered so far this year, up to August 31, 2024. The extended collection period significantly affects liquidity. As seen in the FY24 Annual Report (Screenshot below), the amount is still outstanding.

In their recent earnings concall, the management also clarified that they are working on collecting the payments, but the political turmoil needs to be factored in.

Opportunities:

RDSS Scheme: The Revamped Distribution Sector Scheme (RDSS) plays a crucial role in reducing AT&C losses through infrastructure upgrades, smart metering, and operational improvements. Between 2017-18 and 2022-23, electricity distribution companies (DISCOMs) accumulated losses exceeding ₹3 lakh crore, primarily due to delayed subsidy payments and cash flow constraints, which led to mounting debt. To address this, RDSS focuses on strengthening sub-transmission and distribution networks with a financial outlay of ₹3,03,758 crore. By improving the quality and reliability of power supply, the scheme aims for financial sustainability. Key measures include the installation of prepaid smart meters, which enhance billing accuracy, reduce theft, and enable better monitoring of power consumption. Additionally, the scheme encourages the adoption of modern technologies to improve operational efficiency, helping DISCOMs reduce technical and commercial losses and improve overall financial health.

Now, as mentioned above, Tata Power Delhi (TPDDL) used CYMDIST software to reduce their AT&C losses from 52% to less than 6%, CYMDIST and other CYME products play a critical role in achieving the RDSS goal of reducing AT&C losses by providing advanced network analysis and planning tools. These software solutions help DISCOMs optimize distribution networks through load flow analysis, optimal capacitor placement, and load balancing to reduce technical losses. CYMDIST also improves metering and billing accuracy through load allocation and fault location tools, addressing commercial losses. Additionally, CYME products enhance planning and operations via reliability assessment, contingency analysis, and long-term network simulations, ensuring better preparedness and efficiency. By integrating with smart grid technologies and enabling time-series simulations, these tools support data-driven decision-making, aligning with RDSS goals to modernize infrastructure and reduce AT&C losses to 12-15% by 2024-25.

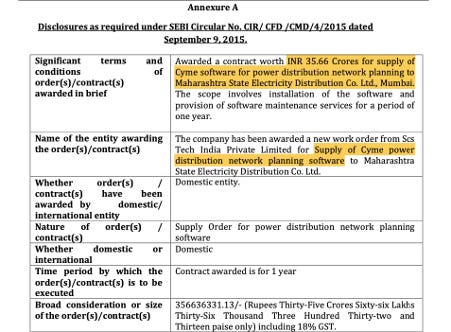

With the early success of Tata Power Delhi and with Tata Power being one of the biggest power companies in India, the usage of CYMDIST software amongst Indian Discoms are only expected to rise. The company bagged a INR 35.66 crores worth of order from Maharashtra State Electricity Distribution Co. Ltd. The order is for one year which includes Installation and Service support.

Curious to see what kind of contracts Trident Techlabs used to undertake before they went public last year, we decided to analyze the public tenders that state discoms put in the public domain.

In December 2022, the company won a bid by BSES Yamuna Power Ltd. (BYPL) priced at Rs. 56.6 Lakhs. The bid was for Consultancy Work for Comprehensive Feasibility Study for Conversion of Existing Overhead Electrical Network to Underground Electrical Network in BYPL. Note: Although, CYMDIST software was a requirement for the bid, however the company won the bid on the basis of its expertise and experience of providing comprehensive consultancy work.

Interestingly enough, BYPL estimated the cost of the project to be Rs. 1.19 crores, however Trident Techlabs managed to finish the project in Rs. 56.5 lakhs.

Tata Power has joint venture with the Government of Odisha to manage power distribution across the entire state. Tata Power has naturally extended its usage of CYMDIST software to do load flow analysis across different zones in Odisha. This has created a natural demand for the software and discoms in Odisha such as TPCODL, TPNODL, TPSODL, TPWODL are using CYMDIST. Going through the capex plan for TPNODL, the company plans to spend Rs. 40 lakh on two license for CYME. Note this is just the licensing fees and the consultancy work around the network planning will be additional expenditure by the company. Similar plans are also mentioned by the other discoms in Odisha.

Other prominent discoms that use CYMDIST are:

- Bangalore Electricity Supply Company Ltd. (BESCOM)

- Adani Energy Mumbai Ltd (AEML)

- Andhra Pradesh Southern Power Distribution Company Ltd (APSPDCL)

- Uttar Haryana Bijli Vitran Nigam (UHBVN)

- CESC Ltd (Kolkata)

Potential usage of CYMDIST in Renewable Power – Solar and Wind: The India Smart Grid Forum (ISGF) has used CYMDIST to study and improve the integration of renewable energy, such as rooftop solar, into India’s electricity grids. This tool helps analyze how much renewable energy can be safely added, identifies challenges like power fluctuations, and evaluates solutions such as energy storage systems. By simulating different scenarios, ISGF has provided valuable insights to utilities and policymakers for planning grid upgrades, managing energy more effectively, and ensuring reliable electricity. These efforts are critical to achieving India’s renewable energy goals and reducing reliance on fossil fuels.

Integrating rooftop solar into India’s electricity grids faces challenges like managing the variable and unpredictable nature of solar energy, which can cause instability and power quality issues. Excess energy during low demand can overload the grid, while limited capacity in existing infrastructure often requires costly upgrades. Ensuring a smooth integration is further complicated by inconsistent policies and regulations across states. Addressing these challenges is essential for scaling up renewable energy while ensuring reliable and efficient electricity supply. And, these challenges can be identified and mitigated using the load flow analysis using the CYMDIST software. One can safely conclude that as renewable energy scale up in the coming future, more and more of these load flow studies need to be conducted for which software tools by CYME will be indespensable and the expertise and consultancy provided by Trident Techlabs will be absolutely required.

Semiconductor Manufacturing: · Government of India is making a big push to become a global leader in semiconductor manufacturing and design, aiming to reduce reliance on imports and build technological self-reliance. The Rs 76,000 crore Semicon India programme and the India Semiconductor Mission is offering generous incentives, including a 50% subsidy for chip fabrication and upfront capital support.

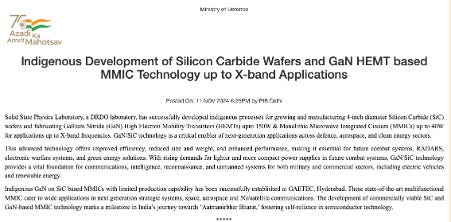

In a landmark development for semiconductor manufacturing, India’s DRDO Solid State Physics Laboratory announced on November 11, 2024, that it has successfully developed indigenous semiconductor technology. This includes 4-inch Silicon Carbide (SiC) wafers, Gallium Nitride (GaN) transistors capable of handling up to 150W power, and MMICs (monolithic microwave integrated circuits) that operate at 40W for X-band frequencies. These cutting-edge components, now being produced at GAETEC in Hyderabad, promise better performance, lower energy consumption, and smaller sizes. The technology has wide-ranging applications in military radar systems, electronic warfare, green energy solutions, electric vehicles, and satellite communications. By achieving this milestone, India strengthens its self-reliance in advanced semiconductor manufacturing, aligning with the Atmanirbhar Bharat initiative, and enhances its capabilities in both defense and civilian technology.

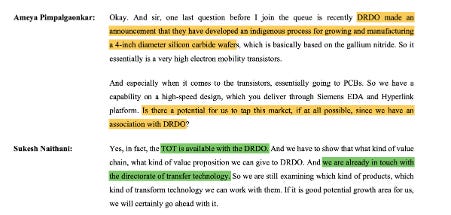

The work order by DRDO mentioned in the previous section where Trident Techlabs is providing AMC support for EDA software is directly used in these kind of semiconductor manufacturing. Trident Techlabs has deep expertise in EDA and Thermal Design which is crucial for breakthoughs as mentioned above. Trident Techlabs also very recently bagged another order by DRDO for High Speed PCB DesignPower–Thermal integrity Analysis Software. Although, a bit speculative in nature, one can always try to connect the dots whether these work orders played a significant role in DRDO’s significant breakthrough.

In the latest earnings concall, the management also confirmed that they are in touch with DRDO to work on this new technology and formulating a proposal on how company can add value.

Overall, the company has significant potential to tap into semiconductor manufacturing with its deep expertise in design services. With PLI schemes being announced by the GoI, it seems the company has significant tailwinds in this particular vertical.

Threats:

With such fast paced verticals, the company has some threats that it needs to battle with:

Clients developing their own in-house expertise: One threat that Trident Techlabs faces which is also faced by other service based companies is that once the project gets over, the only repeat bsuiness from the same customer would be in the form of Annual Maintenance Contracts (AMCs). There are only so many Power Discoms in India that would require Techlabs’ expertise to execute the project and train its employees. To get new projects in the same vertical, the company will have to branch out to new geographiest to diversify. This is exactly what Trident Techlabs is also doing. Last month, they opened up a new office in Middle East to tap into the opportunites available in the power sector. Trident Techlabs is also working with Eaton to discover opportunities in South East Asia.

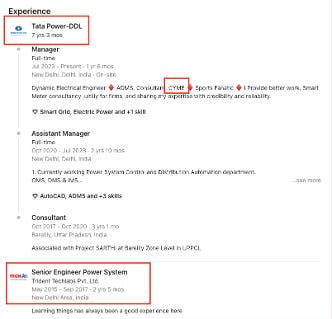

There is also always a possibility that existing clients would want to deepen their in-house expertise. This is exactly what Tata Power DDL has outlined in their FY24 Annual Report with one of their future plan of action being Inhouse development of CYME Portal. There is a good probability that this action will now or in future cannibalize Trident Techlab’s revenue.

This would further worsen if the company’s current clients start poaching their talent. There are always provisions in the contracts to prevent such actions, but they are limited in nature. Below are certain examples of such talent that were previously employed in Trident Techlabs, but now working under TPDDL under the same department:

Better Alternatives than CYMDIST being adopted: ETAP (Electrical Transient Analyzer Program) is a comprehensive alternative to CYMDIST for electrical power system analysis. It offers a wide range of modules including load flow, short circuit, protection coordination, arc flash, harmonic, and transient stability analyses. So far, only Noida Power Company Limited (NPCL) has adopted the ETAP system. But with such lucrative space, there is always a threat of increasing competition.

Valuation:

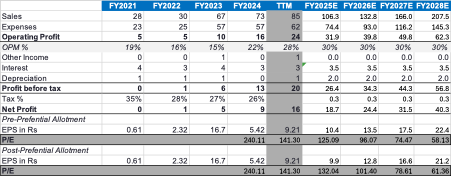

With the kind of returns the stock has displayed since its IPO from last year, investors are left wondering if there is any upside remaining or even worse, is the company overvalued? Trying to make some sense to the valuation, below is the base, bull and bear case in our view:

Base Case:

In our base case, we are assuming that the company will be able to meet its revenue guidance of Rs. 250 crores for FY25 and will be growing at a rate of 25% for the next 3 years. Here we are also assuming that the management will fall short of its Rs. 1000 crores revenue by FY30. To meet the Rs. 1000 crore target, the company will have to do significant fundraising and the details of such has neither been finalized nor outlaid to investors, hence it cannot be baked into our base case scenario. For our base case, the company is trading at 31.2x 3-year forward P/E.

Bull Case:

For our bull case, we assumed that the company will be able to meet its revenue guidance of Rs. 250 crores in FY25 as well as revenue guidance of Rs. 1000 crores by FY30. The stock is trading at 32.4x 3-year forward P/E. Note that this is not a lot different than our base case. This is because in the bull case, the company will have to do significant fund raise to reach the 1000 crores mark and this will further dilute the EPS.

Bear Case:

Finally, for our bear case, we assume that the company won’t be able to meet any of its revenue guidance will be on a growth glide path of 25% and hence accordingly is trading at 78.6x 3-year forward P/E. The stock certainly is overvalued if the bear case is realized.

Conclusion:

At this point, we are refraining from commenting whether our bull and base case makes the stock attractive to buy. This will depend on individual’s perception and risk-taking abilities. For growth investors, it might look like an attractive proposition, whereas for GARP investors, the stock might be in the expensive category already. Overall, we think that the company is certainly poised for significant tailwinds and has expertise and potential to make full use of it. We would further wait for FY25 results to see how management has been able to follow up on their guidance. A lot also depends on the semiconductor acquisition that the company is planning for as the Rs. 250 crore revenue guidance bakes in the acquisition number as well. We have initiated a small position for now and will upsize or downsize our positions depending on the realization of above factors in the coming months.