Q1FY26 Earnings Digest: Edition 2 – HCL Technologies, Ola Electric, Tejas Networks, Just Dial Take the Spotlight

Tracking the Hits and Misses Across Q1 FY26: A Close Look at HCL Tech, Ola Electric, Tejas Networks, and Just Dial

With the Q1FY26 earnings season in full swing, the latest set of financial results shines a spotlight on the evolving stories of India’s diverse corporate landscape. In this edition, we delve into the quarterly performances of HCL Technologies, Ola Electric, Tejas Networks, Just Dial.

These companies, spanning IT, electric mobility, telecom equipment, digital services, together provide a cross-section of the opportunities and headwinds shaping India’s business climate. Their results reflect how leaders across industries are navigating cost pressures, technological shifts, changing demand, and regulatory dynamics, each with its own set of challenges and wins.

As always, our focus is to bring you timely, insightful analysis of the financial and strategic moves behind the headlines: setting the stage for investors, industry observers, and all keen followers of India Inc.

HCL Technologies Q1 FY26: A Story of Strategic Bets and Margin Pressures (Neutral to Weak)

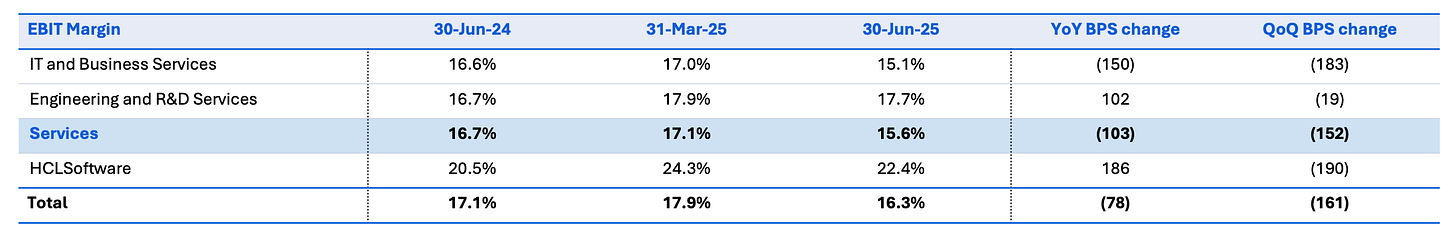

HCL Technologies reported a mixed Q1 FY26, characterized by steady revenue growth but a notable squeeze on profitability. The company's revenue grew 8.2% year-over-year to ₹30,349 crore, translating to 3.7% growth in constant currency. However, this growth was overshadowed by a 9.7% decline in net profit to ₹3,843 crore. This dip in profitability was driven by higher employee costs, a one-time impact from a client bankruptcy, and strategic investments in Gen AI. Consequently, the company revised its full-year EBIT margin guidance down to a range of 17% to 18%, from 18% to 19% previously.

Despite the margin pressures, the underlying story is one of strategic repositioning for future growth. HCL Tech secured new deals with a TCV of $1.8 billion and maintained its full-year revenue growth guidance of 3% to 5%. The company is making significant changes to its workforce strategy, moving away from volume-based hiring to focus on an "elite cadre" of freshers with specialized AI and cybersecurity skills, who will be offered premium compensation. This pivot, combined with a new partnership with OpenAI, signals a strong bet on AI as a key future growth driver.

The Engineering and R&D Services segment was the primary growth engine, with revenue increasing by 11.8% year-over-year in constant currency. While the current quarter reflects short-term pain from strategic investments and restructuring, the continued deal momentum and focused investments in specialized talent suggest HCL Tech is actively retooling for its next phase of growth in an evolving tech landscape.

We covered HCL Tech’s Q1FY26 results in details in our sister substack. Link to the full analysis:

Ola Electric Q1 FY26: A Turnaround Takes Shape (Neutral to Positive)

Ola Electric’s Q1FY26 results mark a noteworthy shift in the company’s narrative. Once saddled with skepticism over losses and operational setbacks, Ola’s latest quarter points to tangible progress on both profitability and innovation fronts.

Key Financial and Operational Highlights

Automotive EBITDA Turns Positive: In June, Ola’s auto segment achieved EBITDA positivity for the first time, with a gross margin of 25.6%. Cost optimizations, especially on the Gen 3 platform, made the business nearly cash-flow neutral for the quarter. Overall, consolidated EBITDA loss narrowed sharply to ₹2.4 billion from ₹7 billion previously, signaling disciplined cost control.

Engineering Edge: Ola’s deep focus on in-house innovation stood out. Notably, their own ABS (anti-lock braking system) will be produced at a fraction of standard industry costs, while “rare earth-free” motors set to launch next quarter promise to ease supply dependencies and reduce expenses.

Cell Manufacturing & Gigafactory: Ola’s proprietary 4680 Bharat battery cell began production in Q1. Deliveries with this technology are slated to start by the Navratri festival. Operating at a 5 GWh scale, these cells are expected to offer 10% higher energy density and lower costs versus standard alternatives, putting Ola in a competitive position with global manufacturers.

Market Guidance: For FY26, Ola targets sales of 325,000 to 375,000 vehicles (with revenue between ₹42–47 billion) and expects a 50% seasonal sales uplift in Q2. The management projects auto EBITDA margins of 5%+ and aims for positive free cash flow by fiscal year end.

Addressing the Challenges

Shrinking Market Share: Despite improved financials, Ola’s market share declined from around 46% to 19% year-over-year, as competitors such as TVS and Bajaj closed the gap. This, coupled with regulatory and service-related setbacks (notably in Maharashtra), underscores operational risks that the company must address through quality and compliance improvements.

Warranty and Quality Focus: Gen 3 warranty claims are down 60% compared to Gen 2 at equivalent ages, signaling major gains in product quality. As earlier models exit warranty, future liabilities are also set to decrease.

PLI Scheme Penalty: Ola disclosed it will not meet government PLI scheme timelines and is provisioning for a ₹1 billion penalty, reflecting the execution risks that still linger.

Strategic Perspective

What truly distinguishes Ola is its relentless investment in deep-tech: heavy R&D spend, vertical integration from cells to software, and a technology-first approach to product development. While the company is moving away from aggressive expansion to a more sustainable and profitable growth model, the vision of transforming from an EV company into a broader energy-tech player remains clear.

Ola Electric’s Q1 FY26 results signal an inflection point: bolstered margins, narrowing losses, and a reinforced tech advantage which is balanced by the reality of market headwinds and execution risk. The next chapters will be defined by Ola’s ability to maintain operational discipline, convert its technological edge into market share, and steadily deliver on its long-term ambitions.

We covered Ola Electric’s Q1FY26 results in detail yesterday. Link to the full analysis:

Ola Electric Q1FY26 Results: The Surprising Turnaround Story Everyone Missed

For years, Ola Electric has been the poster child of India's EV revolution: bold, ambitious, and unapologetically disruptive. But let's be honest, the narrative hasn't always been kind. Sky-high valuations post-IPO gave way to stock price slumps, mounting losses, and a barrage of criticism over customer service woes and operational hiccups.

Tejas Networks Q1 FY26: Weathering the Storm (Weak)

Financial Performance

Tejas Networks faced significant headwinds in Q1FY26, with revenue plummeting to ₹202 crore from ₹1,907 crore in Q4FY25. The sharp decline was primarily attributed to delayed receipt of purchase orders and shipment clearances, particularly for the critical BSNL 4G network expansion of 18,000 sites that was expected to materialize in Q1 but got pushed forward.

Net loss widened to ₹194 crore compared to ₹72 crore in the previous quarter, with EBIT loss expanding to ₹232 crore as fixed costs weighed heavily against the reduced revenue base. Despite the challenging quarter, the company maintained a robust order book of ₹1,241 crore, supplemented by an expected ₹1,526 crore order for BSNL's 4G expansion covering 18,685 sites.

Strategic Developments and Business Highlights

The quarter witnessed several strategic partnerships that position Tejas for future growth. The company entered into a collaboration with Rakuten Symphony to develop integrated 5G Open RAN solutions with global market access, while partnerships with Intel, Lava, and HMD India focus on integrating Tejas's SL-3000 D2M chipsets into laptops and mobile phones.

On the wireline front, Tejas secured BharatNet Phase-III orders for IP routers in two circles and continued to win business from tier-1 Indian telcos for DWDM equipment supporting 4G/5G backhaul capacity. The company also made inroads into private 5G networks with its first order under BSNL's CNPN initiative and expanded its international footprint with network expansion orders from customers in Africa and Europe.

Management Outlook and Growth Drivers

Looking ahead, management remains optimistic about long-term growth prospects, citing continued global investments in fixed and mobile networking technologies driven by 5G deployments, AI data center connectivity, and digital transformation initiatives. The company has significantly expanded its product portfolio in FY25, enhancing its addressable market with advanced 5G maMIMO radios, field-proven 4G/5G core solutions, expanded IP/MPLS router family, and next-generation optical systems supporting 800G/1.2T DWDM.

Strategic partnerships with NEC and Rakuten are expected to provide access to global customers and joint go-to-market opportunities, while the company continues to invest in R&D and international sales expansion to capitalize on emerging opportunities in both private and government sectors.

While Tejas Networks continues to invest in R&D and diversify its product offering, I still rate the Q1FY26 results as weak due to the company’s continued overexposure to BSNL. The operational and financial performance remains hostage to the timing, execution, and health of major government-led projects, particularly BSNL’s 4G expansion: which, when delayed, cause a disproportionate hit to both revenues and profitability. Despite management’s efforts to sign new partnerships and expand into private and international markets, the bulk of the current order book and future growth hinge on BSNL-related orders. This dependence amplifies both the risk and volatility in performance, overshadowing Tejas’s underlying technological strengths and strategic ambitions. Until Tejas meaningfully balances its revenue streams and demonstrates solid execution beyond a single dominant client, its results will remain vulnerable and ultimately underwhelming for investors seeking consistent, broad-based growth.

Just Dial Q1FY26: Momentum Sustained in Digital Search (Neutral to Positive)

Financial Highlights

Just Dial reported operating revenue of ₹297.9 crore in Q1FY26, reflecting a 6.2% year-on-year increase as the company capitalized on broadening its search and services platform. EBITDA for the quarter edged up 7.2% to ₹86.4 crore, with margins ticking up to 29.0%, supported by steady advertising costs of about ₹8.5 crore.

Net profit reached ₹159.6 crore, a 13% rise over the previous year, on the back of a sizable 46.5% gain in other income, which was driven by yield compression in its bond portfolio and expanding treasury gains. The cash and investments position surged to ₹5,429.8 crore, up 14.2% year-on-year, highlighting the company's robust financial health.

Operational Performance

The quarter saw strong platform engagement, with unique visitors growing 6.6% to 193.2 million users.

Mobile continued to dominate, now contributing 86.9% of the traffic and growing 8.7% year-on-year.

Listings climbed to 49.7 million, rising 10.6%, with nearly 940,000 net additions during the quarter.

App downloads continued a steady march upward, crossing 40.7 million cumulatively, and daily downloads pushed 7,600, a 9.8% annual increase.

Paid campaigns stood at 617,340, up by 4.3%, while geocoded listings and content enrichment were bright spots in platform evolution.

Business Developments and Initiatives

Just Dial further enhanced its market positioning through its JD Mart B2B marketplace and digital payment solutions via JD Pay. The platform’s all-in-one app, which integrates search, live TV, maps, payments, and more, continued to draw new users and advertisers alike.

Data richness also improved, with 230.5 million images and 153.7 million ratings and reviews, supporting greater engagement from both SMBs and consumers. The company’s investments in business management tools for SMEs and product innovation are aimed at deeper ecosystem integration and monetization.

Management Guidance and Outlook

Management remains upbeat, focusing on scaling user and advertiser growth while driving innovation in digital tools and solutions. With a thriving cash position and high recurring business from its vast listing base, Just Dial is positioned to benefit as India’s digital economy advances. While some investor attention has shifted to how the company will utilize its growing cash reserves, the underlying business trends remain healthy, setting the stage for sustained momentum in the quarters ahead.

Q1FY26 Results Dashboard: Company Performance Rankings

Based on the comprehensive analysis of Q1FY26 results from both editions of our earnings digest, we've compiled a performance dashboard ranking 8 companies across diverse sectors. This ranking takes into account financial performance, operational metrics, strategic positioning, and overall resilience during the quarter.

This dashboard is designed to give readers a pulse on how corporate India’s leaders are faring across various industries. The diversity of rankings underscores that while several core franchises continue to deliver amid disruption, others are striving to find their footing in an environment shaped by rising costs, regulatory changes, and evolving technology trends.

As always, this scorecard will evolve as companies announce their earnings, offering readers a high-level view and tracking how leaders respond to the ever-changing business terrain.