Q1 FY26 Earnings Digest: Edition 1 – TCS, Anand Rathi, Elecon Engineering, and IREDA Take Center Stage

Exploring the Highs, Lows, and Hidden Stories Behind India’s Corporate Titans This Quarter

Setting the Stage for Q1 FY26 Earnings Season

As the corporate world turns its attention to the opening quarter of the 2026 fiscal year, anticipation builds for what these results will reveal about the broader economic landscape. Q1 earnings reports are more than just a financial snapshot; they serve as a crucial barometer for investor sentiment, market trends, and the resilience of industries in the face of evolving global challenges.

This season, analysts and stakeholders are watching closely for signals of growth, adaptation, and strategic direction. The numbers released will not only reflect past performance but also set expectations for the months ahead. Against a backdrop of shifting macroeconomic conditions: including interest rate movements, supply chain adjustments, and ongoing technological innovation: the upcoming announcements promise to offer valuable insights into the health and priorities of the business world.

At Sabiduria Capital, we will be closely tracking the results of the major companies that are shaping India’s economy. The story of Q1 FY26 is just beginning to unfold.

TCS Results Analysis (Neutral to Weak)

Performance Overview

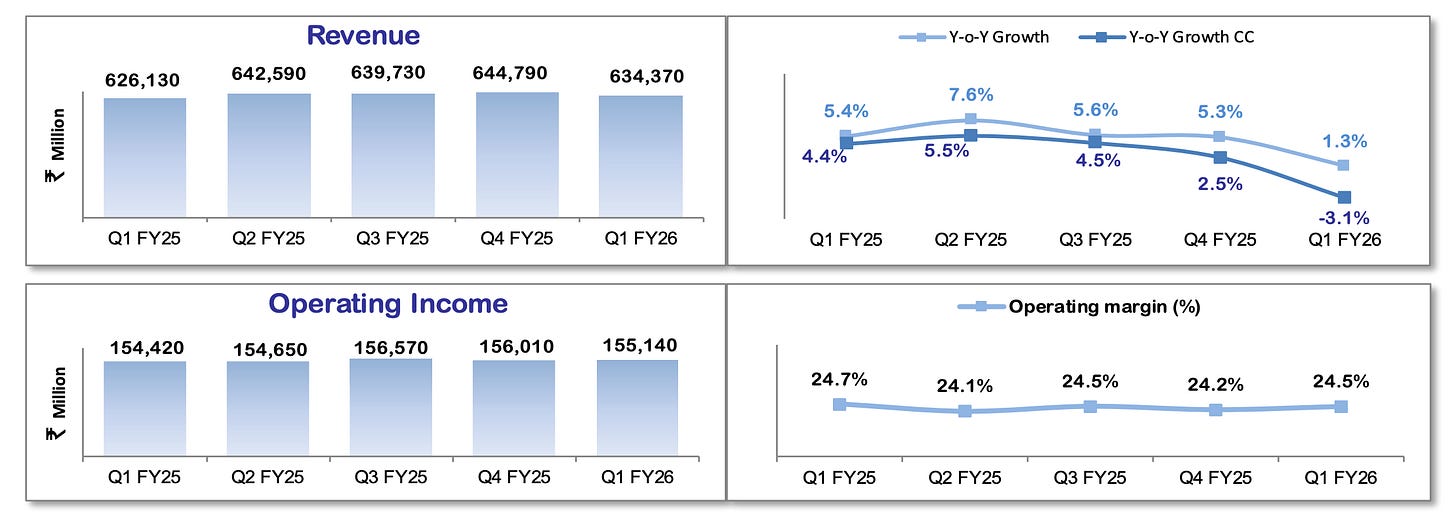

TCS delivered a mixed set of results for Q1 FY26, reflecting the ongoing challenges and resilience of India’s IT bellwether. Revenue from operations grew modestly by 1.3% year-on-year to ₹63,437 crore, but in constant currency terms, the company saw a 3.1% decline, signaling persistent global headwinds and demand softness. However, out of the 3.1% decline, 2.8% was due to the BSNL deal ramp-down which was mostly anticipated and rest 0.5% was attributable to the slowdown in international markets.

Despite the subdued topline, TCS managed to expand its operating margin by 30 basis points sequentially to 24.5%, and net profit rose 6% year-on-year to ₹12,760 crore, beating market expectations. The robust profitability was supported by cost optimization, favorable currency movements, and a strong focus on operational efficiency.

Key Highlights and Strategic Focus

TCS’s order book remained healthy, with a TCV of $9.4 billion for the quarter which was slightly below the previous quarter but ahead of analyst estimates. The company continued to see growth in its BFSI and Consumer Business segments, which together contributed nearly half of its revenue. Meanwhile, Life Sciences & Healthcare, Manufacturing, and Communications & Media segments experienced revenue contraction.

TCS also highlighted its ongoing investments in AI and digital transformation, with over 114,000 employees now equipped with advanced AI skills. The workforce stood at 613,069, with attrition in IT services stabilizing at 13.8%. Attrition at 13.8% is a little bit above the company’s comfortable attrition range between 11-13%. Notably, even with the attrition, the company has not decided on a timeline to hand-out wage hikes as the macro uncertainty is keeping the company at its toes keeping any expense increase at check.

Outlook

Looking ahead, TCS remains cautiously optimistic. While global macroeconomic and geopolitical uncertainties continue to weigh on client spending, the company’s strong deal pipeline and focus on new services, especially AI-led solutions to provide a foundation for future growth. The management’s emphasis on cost discipline and talent development positions TCS to navigate near-term volatility while continuing to shape India’s technology landscape. We will continue to monitor these developments as part of our ongoing analysis of major companies driving India’s economy.

TCS currently trades at around 25x FY26 estimated earnings, a valuation that reflects investor confidence in its margin stability and strong cash generation rather than growth momentum. However, with constant currency revenue declining 3.1% YoY and no clear signs of a near-term demand rebound, upside appears limited. The premium multiple is underpinned by robust profitability: operating margins at 24.5% and net margins at 20.1%; but these are partly supported by one-off gains and cost resets, not structural improvements. With deal conversion remaining slow, attrition ticking up, and the risk of margin pressure from potential wage hikes, TCS’s valuation looks fully priced for stability rather than a growth revival.

Read our detailed Earnings Analysis here: Link

Anand Rathi: Wealth on the Rise! (Positive)

Anand Rathi Wealth delivered a robust set of results for the first quarter of FY26, reflecting strong momentum in India’s wealth management sector. The company’s net profit surged 28% year-on-year to ₹94 crore, up from ₹73.4 crore in the same period last year. Revenue from operations rose 15.3% to ₹274 crore, while total income (including other income) increased 16% to ₹284 crore. This growth was underpinned by an expanding client base and effective cost management, with total expenses rising only 7.8% year-on-year.

Key Highlights and Business Drivers

Assets Under Management (AUM): AUM grew 27% year-on-year to ₹87,797 crore, highlighting significant client inflows and market confidence in the firm’s offerings.

Client Acquisition: The company added 598 new client families in the quarter, taking the total active families served to 12,330, a 19% increase over the previous year.

Operational Efficiency: EBITDA jumped 30.1% to ₹127.7 crore, and the EBITDA margin improved to 46.6% from 41.3% a year earlier, reflecting strong operational leverage and prudent cost control.

Mutual Fund Distribution: Revenue from this segment rose 27% year-on-year to ₹113 crore, indicating continued traction in core business lines.

Highest-Ever Inflows: Anand Rathi Wealth recorded its highest-ever quarterly net inflows of ₹3,825 crore, further reinforcing its growth trajectory.

Strategic Outlook

Despite macroeconomic headwinds, Anand Rathi Wealth’s management expressed optimism for the year ahead, citing a favorable equity market environment, robust domestic demand, and a growing base of HNIs in India. The company’s strong start to FY26 positions it well to achieve its full-year guidance, with Q1 results already accounting for 24% of its annual revenue target and 25% of its profit target. The firm continues to expand its reach, with plans to open new offices internationally and a focus on digital wealth management to drive future growth.

Elecon Engineering Results: (Neutral to Positive)

Elecon Engineering posted robust Q1 FY26 results, with consolidated revenue rising 25% year-on-year to ₹491 crore. This growth was driven by strong demand in core domestic sectors such as steel, power, and cement, while overseas revenue dipped 7% due to geopolitical disruptions in the Middle East. PAT surged 139% to ₹175 crore, boosted by one-time gains from arbitration settlements and investment reclassification; though even excluding these, underlying performance was healthy.

The Gear division saw revenue grow 6% to ₹357 crore, but EBIT margins narrowed to 18.4% from 23.7% last year. This contraction was mainly due to increased employee and brand-building costs in Europe, alongside accelerated depreciation from a new manufacturing facility that is expected to drive future growth as it ramps up.

The Material Handling Equipment (MHE) division, meanwhile, delivered standout results: revenue jumped 139% to ₹133 crore (94% growth excluding arbitration income), with strong order book visibility and expanding export opportunities.

Management remains optimistic about the outlook, citing a robust order backlog and continued momentum in domestic markets. The company maintains a strong net cash position of ₹550 crore, supporting planned capital expenditure and further expansion. With new capacities coming online and ongoing investments in digital and export initiatives, Elecon Engineering is well-positioned for sustained growth in the quarters ahead.

IREDA Q1 FY26 Results: A Closer Look at Asset Quality (Neutral to Weak)

IREDA’s Q1 FY26 performance paints a picture of robust business growth tempered by emerging asset quality concerns.

The agency’s revenue from operations surged 29% year-on-year to ₹1,947.6 crore, underpinned by a 27% expansion in its loan book to ₹79,941 crore and healthy increases in both loan sanctions and disbursements, which rose 29% and 31% respectively compared to the prior year.

This momentum reflects IREDA’s central role in financing India’s renewable energy sector, with net interest income also climbing a solid 36% to ₹691 crore. Despite these positive indicators, the quarter was marked by a sharp 36% decline in net profit after tax to ₹247 crore, as total expenses ballooned by 60%: driven by higher financing costs and notably, increased impairment provisions linked to a deteriorating asset base.

The most pressing challenge highlighted in the results is the marked rise in non-performing assets. Gross NPAs jumped to 4.13% from 2.45% at the end of FY25, while net NPAs climbed to 2.05% from 1.35% over the same period, signaling heightened credit risk in IREDA’s portfolio.

This deterioration in asset quality, despite a robust net worth now exceeding ₹12,000 crore, points to the inherent risks of rapid expansion in a sector where project execution and borrower health can be volatile. The agency’s response has been proactive, with a strategic move to classify its bonds as long-term specified assets under Section 54EC of the Income Tax Act, which should help attract more capital at lower costs and strengthen its funding base.

Looking ahead, IREDA remains committed to supporting India’s renewable energy transition, leveraging its strong capital position and growing loan book. However, the rising NPA trend underscores the need for vigilant risk management and a balanced approach to growth.

In summary, Q1 FY26 saw India’s top companies: from IT and finance to industry and green energy, deliver mixed results as they navigated growth, costs, and asset quality challenges. Each sector’s story reflects both resilience and areas for caution. At Sabiduria Capital, we’ll keep a close watch on these trends as India’s corporate landscape continues to evolve.