Market Notes - 24th January:

The Indian stock market experienced a volatile session on January 24, 2025, with major indices ending lower and snapping a two-day rally. Here's a summary of the key developments:

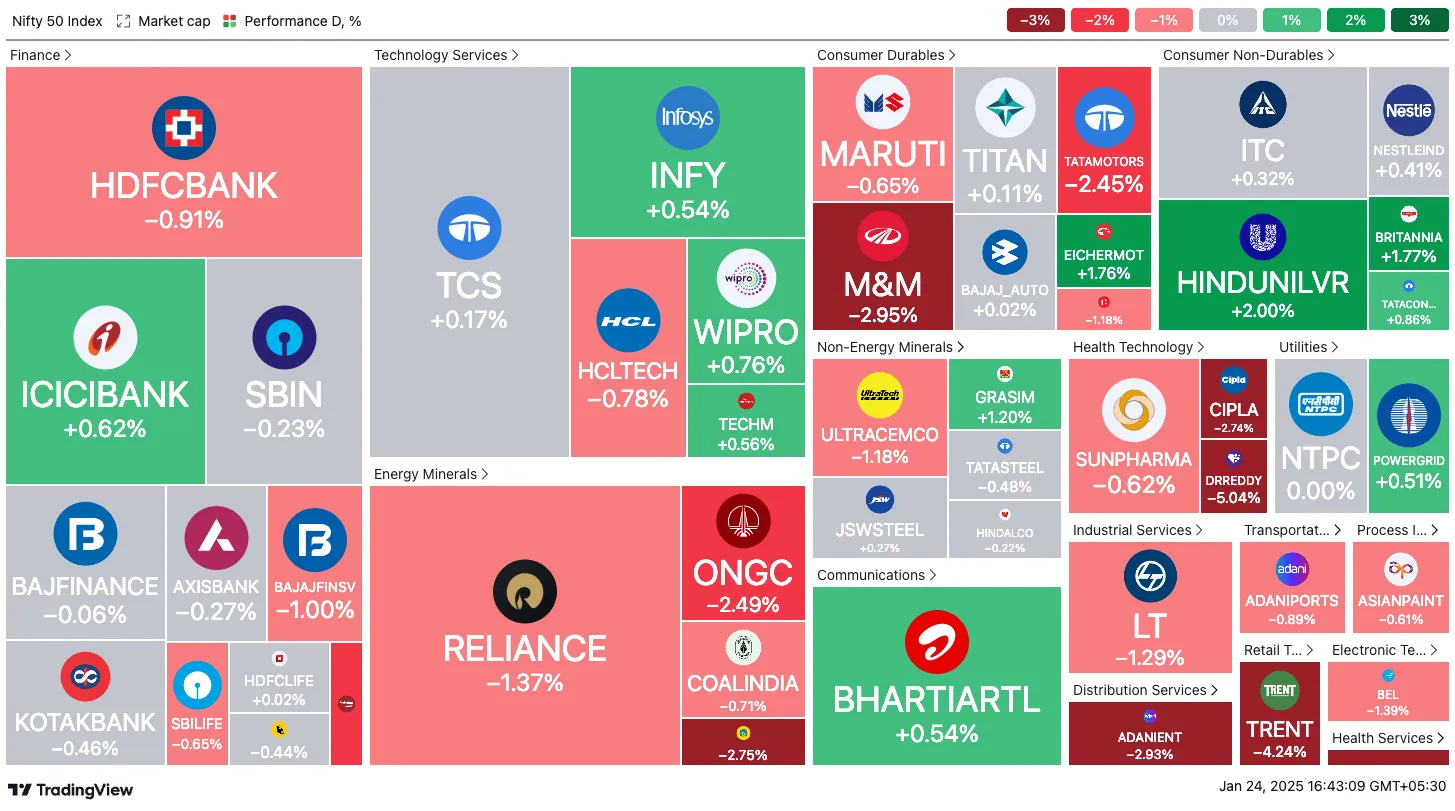

Market Performance

Nifty 50: Closed 0.49% lower at 23,092, falling 255 points from the day's high.

Sensex: Ended 0.43% down at 76,190, dropping 795 points.

Weekly Performance: Both indices concluded the week with losses, marking the third consecutive week of declines.

Broader Market

Nifty Midcap 100: Declined by 1.55%.

Nifty Smallcap 100: Tumbled by 2.35%.

Small-cap stocks experienced heavy selling pressure, with both mid-cap and small-cap indices finishing the week with drops of up to 4%.

Factors Influencing the Market

Profit Booking: Early gains were wiped out due to profit booking in the second half of the trading session.

Weak Q3FY25 Results: Companies reporting earnings below street estimates faced severe sell-offs.

FPI Outflows: Foreign Portfolio Investors (FPIs) continued to withdraw funds, with total outflows in January reaching ₹66,321 crore.

Valuation Concerns: Overall market valuations remained a concern for investors.

Trump's Economic Policies: Worries over Donald Trump's economic policies weighed on market sentiment.

Global Context

FPI outflows were not limited to India, with other Asian markets also experiencing withdrawals. Rising US bond yields were cited as a factor prompting overseas investors to shift funds back to the US.As the market looks ahead to the Union Budget 2025-26, set to be unveiled on February 1, 2025, investors remain cautious amidst the ongoing volatility.

Results that Matter:

Tejas Networks reported a significant turnaround in its Q3 FY25 results, with a consolidated net profit of ₹165.57 crore compared to a net loss of ₹44.87 crore in Q3 FY24. Revenue from operations soared 371.86% year-on-year to ₹2,642.24 crore. However, despite this strong year-on-year performance, the market reacted negatively, with the stock price plummeting over 10% on the day of the announcement. This adverse reaction was primarily due to weak sequential performance, with net profit falling 39.80% and net sales declining 5.95% compared to Q2 FY25. Additionally, investors were concerned about the sharp decline in the company's order book, which stood at ₹2,681 crore at the end of Q3FY25, well below the last five-quarter average of about ₹7,700 crore. The market's response also reflected worries about rising inventory levels and potential growth sustainability issues.

Cyient reported disappointing Q3 FY25 results, with net profit declining 31.6% quarter-on-quarter to ₹127.7 crore, despite a modest 0.5% increase in revenue to ₹1,909.8 crore. The market reacted severely to these results, with Cyient's shares plummeting by nearly 20% on January 24, 2025, hitting a 52-week low. The negative sentiment was further exacerbated by the unexpected resignation of CEO Karthikeyan Natarajan and a downward revision of the company's FY25 revenue growth guidance from flat to -2.7%. Investors and analysts expressed concerns about the leadership change, weak execution, and potential disruptions to the company's strategic direction. Several brokerages, including JP Morgan and Emkay Global, downgraded Cyient's stock and lowered their target prices. The combination of weak financial performance, leadership uncertainty, and reduced guidance has significantly dampened investor confidence in Cyient's short-term prospects.

Broader Developments:

In December 2024, retail inflation showed a notable decrease for both agricultural and rural workers in India. The All-India Consumer Price Index for Agricultural Labourers (CPI-AL) dropped to 5.01% from 5.35% in November 2024. Similarly, the Consumer Price Index for Rural Labourers (CPI-RL) declined to 5.05% from 5.47% in the previous month.

Moody’s Ratings, in its report on corporate performance in South and Southeast Asia’s emerging markets, highlighted the depreciation of the Indian rupee. Over the last two years, the rupee has weakened by approximately 5%, and since January 2020, it has fallen by 20%, making it one of the weakest-performing currencies in the region. Despite this, Moody’s assessed that only six out of the 23 rated Indian companies are significantly exposed to the effects of dollar strength. However, these companies are well-positioned to manage the risks, as they have sufficient mitigating factors in place to counter the impact.

The HSBC Flash PMI report shows Indian private sector growth slowed in early 2025 due to weaker new business and output, with services losing momentum despite strong manufacturing growth. The Composite Output Index fell to 57.9 in January, its slowest in 14 months but above the long-term average of 54.7. Meanwhile, the Manufacturing PMI rose to 58.0, its best since July 2024. Business confidence improved, driven by manufacturing optimism, though service sector sentiment dipped to a three-month low amid competition concerns.

Expert Talks:

Pankaj Tibrewal on how to make sense of this market and sectors that are looking attractive:

Tibrewal observes that markets have pulled back following a strong rally in November and December. Over the past 5-6 months, he has maintained a cautious outlook due to factors like tight liquidity, subdued government capital expenditure, and fluctuations in the DXY and bond yields. However, he notes encouraging developments, such as easing liquidity conditions, increased government spending, and moderation in both the DXY and bond yields. He believes the market could find its bottom within the next 1-2 months and has started adopting a more optimistic stance.

On the earnings front, Tibrewal projects Nifty’s growth to be around 5-6% for the year. He expects the third quarter to represent the trough for earnings downgrades, with recovery likely in the fourth quarter and the first quarter of fiscal year 2026. Tibrewal also suggests that a further 5% decline in the Nifty would make valuations more compelling, bringing the P/E ratio to 18-19 times—levels he considers attractive for entry. Additionally, he points out that an earnings yield on the Nifty exceeding 5%, combined with bond yields at 6.7%, would enhance the market’s appeal.

Investment Themes and Strategies

Tibrewal highlights several popular investment themes, including public sector undertakings (PSUs), energy and renewables, manufacturing, capital expenditure, and real estate. Despite these opportunities, he urges caution with companies whose valuations are driven by narratives unsupported by strong cash flows, healthy balance sheets, or reasonable valuations, particularly in the electronics manufacturing services (EMS) sector. He also warns against sectors experiencing peak margins, as they may face profitability pressures ahead.

As a contrarian, Tibrewal sees potential in sectors like metals, cement, and specialty chemicals, which he believes are at the bottom of their margin cycles and positioned for a profitability rebound. Additionally, he emphasizes the importance of identifying companies with strong management teams, market share gains, leadership transitions, and tactical opportunities that could drive long-term value.